Local family legal firm Avalon Legal is blogging for us about all things legal, for families

In difficult times

Our blog this month is written from personal experience. As many of you know my mum passed away from Covid 19 recently. This has been a very emotional and difficult time for our family and has had many challenges that continue.

My parents both had Wills and Powers of Attorney for health and finance and had them registered with the court. I am so relieved that we had these in place. Even with these documents’ things have not been easy.

Registering the power of attorney with all the utilities, bank and council has been relatively straightforward our end, however due to Covid working the application of the power of attorneys has been arduous. Letters back and forth to the bank, due to them losing paperwork. This has caused frustration and a need for us to complain to the banking ombudsman. Can you imagine how much worse this would be without the power of attorney though?

The health power of attorney has come into play due to the health needs of my father. I am so relieved to have this document. The hospital, GP and any care services will only deal with family if there is a power of attorney registered. This one document has ensured my father gets the care he needs, and I get informed and kept up to date.

We hear so many times that people wished their relatives had taken out powers of attorney whilst they had capacity. I cannot stress enough the importance of these documents. It is also important to not ‘do it yourself’ unless you fully understand the implications, should the document be challenged or questioned.

When you engage our services at Avalon Legal you will receive a fully insured and professional service. Colin has worked in different law firms and has reached partner level. Three years ago, he took the opportunity to work for himself. This has enabled him to give an excellent service that is bespoke and based around the needs of the clients. Read our reviews here.

If you would like to discuss making a Will or power of attorney, contact us on the details below.

For further information contact Avalon Legal on 07506 583669 or email: info@avolonlegal.uk

November

Remembrance and the aftermath.

We are currently in a time of remembrance, with socially distanced Remembrance Sunday services having taken place across the UK and beyond, remembering the fallen in conflict around the World. Not only service personnel but also the civilian casualties, the innocent men, women and children who have been caught up, through no fault of their own.

Making a Will was, and still is, very important for the servicemen and women on active duty even in peacetime, the major difference being this was and still is called a “Privileged Will”, which extended and extends to any soldier on active service or mariner or seaman being at sea. The term soldier also includes shore-based naval or marine personal and members of the RAF, although the term “Active Military Service” is open to some doubt with cases including Re Jones (1976) and Re Rapley (Deceased) (1993) calling into question what active service is.

If not written before deployment these Wills were often written in the field using scraps of paper and whatever writing implement could be found, an example of which is below, taken from a national newspaper archive.

A game of noughts and crosses and a Will leaving a collection of Sir Walter Scott books to his best friend and the rest of his possessions to his mother was all that was found of Philip Woollatt.

The First World War soldier’s pocketbook – containing the informal Will that all servicemen carried – was found furrowed by a bullet after a battle in July 1916 in which it is presumed the 21-year-old died.

This practice still carries on today so that the serviceman or woman can direct their estate to the right person or persons, rather than die intestate.

During this period of remembering and reflecting, if you are worried about your own estate please contact us.

Avalon Legal

For further information contact Avalon Legal on 07506 583669 or email: info@avalonlegal.org

Funeral Planning

With Autumn still bidding its beautiful farewell to Summer, and Halloween and Winter fast approaching, let us look at Funeral Planning…

Failing to account for the cost of a funeral can leave your loved ones with a financial struggle at a time they least need it.

In 2016, Royal London’s National Funeral Cost Index found the average cost of a funeral was £3,675. In 2019 that has risen to £ 4,417, which could in 15 years be as much as £9,522.00. Even a basic “no frills” funeral today can set you back £1,500.

When you add extras, such as flowers, a memorial or headstone, and catering at the wake, you could expect to add an additional £2,000 to the bill.

If you’re planning for the future, one of the best things you can do after doing your Will with Avalon Legal is pre-arrange your funeral.

Arranging a funeral can be a stressful experience, especially while trying to cope with grief after bereavement. You can help your friends and family by making decisions in advance and letting them know that you’ve already planned what you want.

Think about your funeral wishes

How do you want to be remembered? If you’re thinking about what you want your funeral to be like, here are some key questions to ask yourself:

- Would you prefer a cremation or burial?

- If burial, where do you want to be buried? Do you have a plot already or would your loved ones need to buy one?

- If cremation, what do you want to happen to your ashes? Would you want them to be scattered in a special place, kept at home, or interred in a burial plot?

- Do you want a religious funeral service or non-religious?

- Do you have a particular place of worship or venue in mind?

- What kind of coffin would you like? Traditional wood, cardboard, wicker, or something else?

- Do you want a special hearse? Motorbike hearses and VW camper vans have become popular in recent years.

- What music would you like played? Would you go for traditional hymns or pop music?

- What will your wake be like? Would you like a certain type of food or drink serving?

- Do you want well-wishers to donate to a specific charity in your memory?

Once you’ve thought about your funeral wishes, it’s important to make a note of your requests or talk to a loved one about what you want. It might be a difficult conversation, but when the time comes they’ll be glad that they know what to do, rather than face tough decisions about your funeral.

Pre-paid funeral plans

If you know what kind of funeral you’d like, a pre-paid funeral plan is a way for you to not only pre-plan your send-off, but to pay for it in advance too.

You’ll be able to secure the Funeral Director fees at today’s prices, beating inflation and rising funeral costs. You can make important choices about your funeral, such as whether you’d prefer burial or cremation, as well as make a note of all your special requests, like funeral music.

When the time comes, your nominated Funeral Director will receive a list of all your requests and can take care of the arrangements. Your loved ones will have less to worry about at an already difficult time, and they’ll know you’re getting the funeral you wanted.

Karen Wells,

Avalon Legal

For further information contact Avalon Legal on 07506 583669 or email info@avalonlegal.org

August

Why do businesses need terms and conditions?

The terms and conditions outline the contract between you and your customer for your supply of goods or services. This also regulates your business relationship.

The purpose of setting out terms and conditions is to record what you have agreed and to layout the inflexible terms under which you will accept business.

Businesses will focus on generating clients and selling goods or services but without a contract or terms and conditions of business, it will be difficult for businesses to clearly show what they have agreed to provide and what isn’t included in their charges.

The terms will:

• Define the contract between both parties;

• Set out your business procedures;

• Limit your liability; and

• Protect your business and your rights

Payment upfront

You still need terms of business, which acts as a contract between you and your customer/client.

Litigation

All businesses want to avoid litigation as it is stressful, costly and damaging to your business. Terms and conditions help to avoid litigation as they should set out clearly the contract between the business and your customer/client.

Outlining the agreement

The contract is a written agreement between two parties and details the terms of a transaction. The contract states the work that will be performed, along with important information like due dates and costs. It is better to keep the contract as simple as possible.

• State the full scope of works;

• Outline a general timeline if possible and if possible exact due dates for each milestone. This isn’t always possible if waiting on a third party;

• Everything discussed should be included in the contract;

• Payment amounts and terms should state how many days the client has to pay the invoice and whether it is to be paid before or after work commences; along with payment method. It should also state if interest is to be charged on late payments;

• Outline the circumstances under which the contract can be terminated and how that will be handled. If dispute mediation becomes necessary, the contract should also outline how that will take place;

• If necessary, one or both parties may choose to include a noncompete or nondisclosure clause; and

• State terms related to failed obligations. If, for instance, payment isn’t remitted by a certain date, the contract should outline what late payment fee will apply and any interest charges that will occur.

Protecting both business and client

Having clear expectations in a contract makes enforceability easier. Knowing that the terms of business are in writing can put pressure on all involved parties to meet their obligations on time. The service provider will probably even routinely check the contract to make sure the work is progressing as agreed.

If an issue arises, having the agreement in writing will make enforcement much easier. If the client decides to work with a different agency halfway through the project, the provider could take legal action to be paid for work performed.

Financial agreements

The contract will ensure the service provider receives payment in a timely manner. For big projects, this generally means multiple small payments as certain milestones are reached. Payments can also be asked for in stages.

A written contract may not always be enough to get paid on time. It is essential to issue invoices and reiterate the terms on that invoice. Give your clients/customers different options to make payments.

Closing the contract

No business wants to proceed with legal action but the contract between both parties lays out exact terms and conditions for that service or purchase. The contract should be kept for 6 years after closure in case a later issue should arise.

Keeping a business terms and conditions template that you can adjust based on lessons learned from previous business transactions is a good idea.

July

Pandemic - A family’s perspective

March 23rd 2020 is a date to remember. The government put the country into lock down as cases of Corona Virus started to escalate. The whole country has experienced this together bringing solidarity and unity. The unprecedented appreciation for the NHS and the Thursday applauds for our carers has unified us in reducing the rate of Covid 19 infection.

Never in my life did I expect our eight-year-old daughter to experience a pandemic. Naïve, maybe but how could any of us have expected the spread of this virus to kill over 45,000 people?

Online lifeline

Our working lives and home lives were changed and although we have a new normal, that we have adapted to, we miss certain parts of our old lives. My husband works from home and has been able to homeschool our daughter and work from home. Being self-employed has its advantages and disadvantages. It became clear after a month of homeschooling that an online School would be a good way forward. We signed our daughter up to it and for two hours a day she has structure and an online classroom, with a very good teacher.

Having realised that this was going to be our new normal for a while we also signed our daughter up to online French lessons, theatre group, drum and piano. These have been really successful and she has progressed very quickly. The lack of social interaction with face to face lessons has not been all positive though. She misses seeing her friends in person and being able to share in the learning environment, something I think we took for granted before corona virus.

Our daughter has had the occasional times where her emotions have overcome her, and she has felt isolated from her peer group.

New rules

As parents our concern is how our daughter will cope with the new normal at school in September. Things will be very different and the usual hugs and holding hands of the year three children will not be allowed. Moving up a year group, having not physically attended her school since March will cause some anxieties. New teacher, new rules and friends she hasn’t played with for 6 months. How would we as adults cope with such an enormous change? Children are resilient and do cope with change better than we think but such a lot of changes in one go will provoke that ‘butterfly’ feeling in their tummies.

What will the schools put in place to help the children reintegrate within the school and help them to overcome their fears and worries? The government has provided online resources for Schools to assist with supporting mental health for staff and pupils. They should be able to express their anxieties and concerns about the coronavirus pandemic and have resources to support additional mental health needs. Will this be enough? Only time will tell and listening to your child and hearing their concerns will empower parents to liaise with the school for support.

Along with this there will be extra funding for schools to support those that have been disadvantaged but hasn’t every child been disadvantaged? This would be a good time to review the already underfunded schools and reduce classroom size.

Focus on family

Since the lockdown measures were reduced, we have walked, scooted and ridden bikes in our local park; and now we meet her friends for a socially distant scoot in the park too. We have enjoyed our walks as a family and have definitely exercised more since the beginning of the lockdown.

We have also enjoyed as a family time together without having to rush about for after school activities.

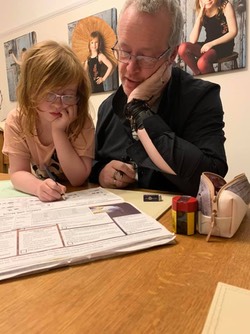

Our business is private client work and we were able to transition to online appointments quite easily. We embraced the technology and will continue to offer this service post pandemic. Although we run Avalon Legal together, I am also a nurse and have worked throughout the pandemic, so parenting, home Schooling and running the business has majorly been handled by my husband. I decided it would be good to interview Colin and see his take on the situation he finds himself in and how it has affected him.

I asked my husband these questions:

What’s it like working from home during the pandemic?

Nothing has really changed for Avalon Legal as I worked from home before the lockdown, although I have not been able to visit clients. However, with platforms like Zoom, FaceTime, Teams etc this has not presented to much of a problem. The majority of my morning is spent schooling Grace or trying to keep her entertained, so a lot of my work is done after 4pm once we’ve had our walk, scoot etc.

What advantages have there been?

One of the major advantages in working from home during the pandemic has been that, whilst working, I have also had a big hand in looking after Grace and helping with her education and wellbeing.

New and existing clients have been very understanding and the majority of the appointments were after 4pm, which meant we were still able to go to the park for daily exercise.

What disadvantages have there been?

The real disadvantage has been not being able to meet clients face to face to discuss their particular matters and to get to know them personally. Zoom etc are good tools but no substitute.

What challenges have you faced?

I think one of the challenges has motivation to do things. In the early days of the lockdown we decorated one of the bedrooms and some of the other jobs that needed doing to the house, but as lockdown continued the enthusiasm waned.

Another major challenge has been to continue with schooling especially when home schooling is alien for a lot of people.

However, I do think that this has been the same for a lot of people I have spoken too, especially fathers who have partners on the front line.

What have you missed during this period of time?

One of the things I have missed during the pandemic has been the ability to go to the gym several times a week and meet friends and family. My parents are in the west Country and with the lockdown on travel we have relied on text/telephone, although it still hasn’t stopped our daughter from asking when we would be seeing grandma and grand-dad and her uncle.

As we all find our new normal, it’s important to take time and reflect on what has been positive and what change will be kept going forward. Embrace change and adapt, it brings about new challenges and re-models our lives, sometimes for the better.

Karen Wells,

Legal Editor

Local Mums Online

Special Offer for Local Mums members

We are offering all Local Mums Members 10% discount on all our legal services. More details of our Local Mums discount here.

Please contact me on 02086444441 or 07506583669 or email info@avalonlegal.org

June

Vanity Fair

Hands up if you have read Vanity Fair. I must admit I have read this - and watched the series - and I loved it!

This classic novel, by English writer William Thackeray, was first published in the magazine Punch in 1847; not as a book but serialised in a magazine. This is set around the times of the Napoleonic wars and charts the life and loves of two friends.

For those of you not familiar with the story I shall give you a synopsis. There is a young orphan girl Becky Sharpe and she is destitute, with nowhere to go. A strong-willed and determined girl she aims to make her fortune on the back of others.

Becky Sharpe befriends a lovely, well-refined girl called Amelia; Amelia has considerable wealth but is gullible and not worldly-wise. Becky is manipulative and conniving and aims to use her rich heiress friend to her own advantage.

Becky Sharpe is forced to become a governess and marries into wealth, while Amelia marries a man disinherited by his father.

Lets now look at the legalities in more depth...

Closer analysis of this story and the law around inheritance and succession offers good discussion points.

The right to gift your property, chattels, real estate etc. to whom you wish is specific to English and Welsh Law and differs from the rules of many civil law jurisdictions.

Matilda Crawley knows that her family want to inherit her enormous wealth but she has the upper hand and keeps them all guessing as to who will inherit her fortune. If Captain Rawdon is not left anything, he has no claim. However, if this had happened after 1975 then, possibly, he would have been able to make a claim under the Inheritance (Provision for Family and Dependents) Act 1975.

Captain Rawdon relied on the charity of his aunt to maintain his lifestyle so may qualify as a ‘person being maintained’. Historically though he had no rights.

In 1814 the primary piece of legislation governing Will writing (The Wills Act 1837) hadn’t yet come into force. In 1796 there was an introduction of taxing estates and this was to help against Napoleon.

Disinheriting a relative was also prevalent in the Osbourne’s story line. George disobeyed his Father’s request to go to war and the request to marry Amelia. George was at risk of disinheriting himself.

In the early 1800s, Inheritance law was different from when Vanity Fair was set and in 1894 a new inheritance tax legislation was introduced to help the government pay off a £4m deficit.

Death tax (as it became known), in some form, has been in place since 1694 and many tax avoidance schemes have been used by people, like Mr Osbourne, who will gift or give away assets over a lifetime to avoid any charges.

While we do not advocate tax avoidance, with proper estate planning you can minimise any potential inheritance tax due.

Karen Wells,

Avalon Legal

For further information contact Avalon Legal on 07506 583669 or email info@avalonlegal.org

April

Myth-busting - Lasting Powers of Attorney

With so many people going down with Covid-19 and the increase in reports of Mental Health cases I thought it might be worth highlighting a few myths surrounding Lasting Powers of Attorney using an article first published by the Society of Will Writers in 2019.

There are common misconceptions on why an Lasting Powers of Attorney (LPA) may not be necessary which this blog explores further.

1) “I don’t need an LPA because my next of kin can make important decisions on my behalf”

Not true. No-one can act on your behalf or make decisions on your behalf if they have not been legally authorised to do so.

2) “My Will has appointed executors, so they’ll be able to make decisions on my behalf.”

Not true. A Will is entirely separate to an LPA. Executors appointed in a Will only have the power or authority to distribute your estate as requested and in line with your Will, on death. They have no authority to make decisions on your behalf during your lifetime.

3) “I don’t need an LPA until I become elderly and of ill health”

Not true. An LPA can be made by anyone over the age or 18 who has full mental capacity. Someone may lose capacity or no longer be able to make decisions due to an accident, being in a coma or other mental illness.

The sooner you put an LPA in place the better, as you know provisions will have been put in place in the event the unthinkable happens. If you wait and, in that time, lose capacity, it will be too late to get an LPA and your loved ones will need to apply for a Deputyship Order from the Court of Protection. This will not only take a long time but also a costly process.

4) “Once my health and welfare LPA is registered, it means someone else can make decisions for me and I don’t want that while I have capacity”

Not true. A health and welfare LPA only comes into effect when the donor loses capacity even if the LPA has been registered.

5) “Getting an LPA is expensive”

The cost of registering an LPA is £82 per document. In comparison, if you fail to make an LPA and lose capacity, your family will be left with no other option but to apply for a Deputyship Order, this will cost significantly more.

6) “My partner and I have joint bank accounts so we don’t need LPAs”

Not true. This is always the most alarming to couples when they are told that even if they have a joint bank account, this does not mean the partner will be able to automatically access funds to pay for bills, mortgage or general expenses. If the spouse was to lose capacity, the bank have the ability to remove access and freeze the account until they receive a copy of the registered LPA which is extremely stressful for the spouse.

If you are worried about capacity for either yourself or a loved one then do not delay; please contact Colin E Wells of Avalon Legal, on 02086444441 or 07506583669 or email info@avalonlegal.org

Death matters...

In this Covid-19 (Corona Virus) outbreak, approximately 60% of

the adult population of England and Wales do not have any

provision for their loved ones on death.

The fundamental question is WHY?

The laws surrounding Wills date back to before the modern legal system...even William Shakespeare left a Will, leaving his wife the second-best bed.

The current law regarding Wills and the disposal of one’s estate goes back to the Wills Act 1837, written during the early years of Queen Victoria’s reign, states in plain English that a person is free to give his or her wealth to anyone and that anyone may benefit from such wealth provided the provision is written and executed in accordance with the law.

The majority of the Wills Act 1837 is current today as it was when first placed on the statute books and has only been amended four times in last 180 years, the last time in 1995.

So what does this mean for me...the common misconceptions are: I am married and everything goes to my spouse...

A. It is sad to say that unfortunately we are not immortal and cannot take our possessions with us, but why do I need a will, surely my family will get everything anyway?

a. The law sets out clear rules what will happen to your Estate – property, personal possessions and cash – if you die without a Will. Passing away without a Will is known in legal terms as dying Intestate and the rules that govern the distribution of the Estate in such circumstances is known as the Law of Intestacy.

b. Under the Administration of Estates Act 1925 the spouse and children do not automatically receive everything in the deceased’s Estate. Invariably the surviving spouse is treated harshly because the widow’s entitlement is limited to the sum of £250,000 plus personal effects and any accounts held in joint names, with limited interest in only halfthe balance which remains after that which may pass to any children.

c. If there are no children, surviving siblings or parents then the surviving spouse or civil partner under the Guidelines of the Civil Partnership 2004, takes the sum of £250,000 and one half of the balance, with the other more remote relatives taking the other half.

d. The surviving spouse or civil partner can only take the whole estate if there are no surviving children, siblings or parents.

B. So why make a Will?

a. It is clear from recent government statistics and in conjunction with the Chancery Division of the High Court, Probate Registry that many of the population die each year without making a Will, creating much heartache and anguish for the loved ones they leave behind. The most common time for families to fall out is at a funeral when emotions are already running high and the event is further charged by distant relatives or indeed close members of the family asking the question “well what did the deceased leave me?”

Indeed, it is quite common for a high percentage of litigation cases to involve disgruntled relatives following the death of a loved one. The most recent example being Gill v RSPCA 2010 which could have some serious consequences and escalation of serious costs which will be borne by the Estate or the parties involved in legal action.

b.Your Will may be as simple or as complicated as you like, however the outcome will be the same, leaving what you have to whom you would like to receive it.

c. In the first instance a consultation is normally beneficial in the comfort of your own home so that the I may discuss your requirements. The information you give me will be drafted into a document that I hope you will be satisfied with until your circumstances change.

d. It is my intention that you do not become just another statistic in the blame and shame society.

C. So why should I regularly review my Will?

a. If you made your Will some time ago it might be time to review it especially after the changing of personal circumstances such as marriage, divorce, new addition to the family, death of a family member or a move.

b. A change to your financial situation, an increase in your property value and even new tax laws and legislations can also make an update to your Will necessary.

c. A valid Will is vital if you want to avoid any misunderstandings after your death and will avoid costly and lengthy litigation.

d. If you remarry for instance, your current Will is no longer valid, and you die under the rules of Intestacy and the State will decide who will benefit from your Estate.

e. If you remarry you will also need to make a new Will that specifically takes into account your new marriage particularly if you wish to leave your Estate to children from your previous marriage or to your new partner on the provision that your Estate reverts to your children on his or her death.

f. A review helps you to be sure that the people or

charities you want to benefit from your Will will

continue to do so. Often changing your Will can

be as simple as drawing up a codicil (an addition

or change to existing) that can be signed and

kept with your existing Will.

Author bio

I take pride in my professional reputation for taking the time to

not only get to know you as a client but as a person and get to

understand what you want and what you would like your

beneficiaries to have.

With over 18 years’ experience in this specific area of Law, Avalon Legal specialise in Wills, Powers of Attorney, Probate and Estate Planning and are based in Epsom, Surrey.

I am a Fellow of the Institute of Paralegals, a Member of the Society of Will Writers, and a Member of the Federation of Small Businesses. This means that your service will be professional, fully advised and is a fully insured service.

Special Offer for Local Mums members

We are offering all Local Mums Members 10% discount on all our services. More details of our Local Mums discount here.

Please contact me on 02086444441 or 07506583669 or email info@avolonlegal.uk

Colin Wells

Avalon Legal

Phone: 020 8644 4441

Mobile: 075 0658 3669

Email: info@avolonlegal.uk

Suite 135,

Reaver House

12 East Street

Epsom

Surrey

KT17 1HX

www.avalonlegal.uk